Access your business accounts,

day or night

from anywhere

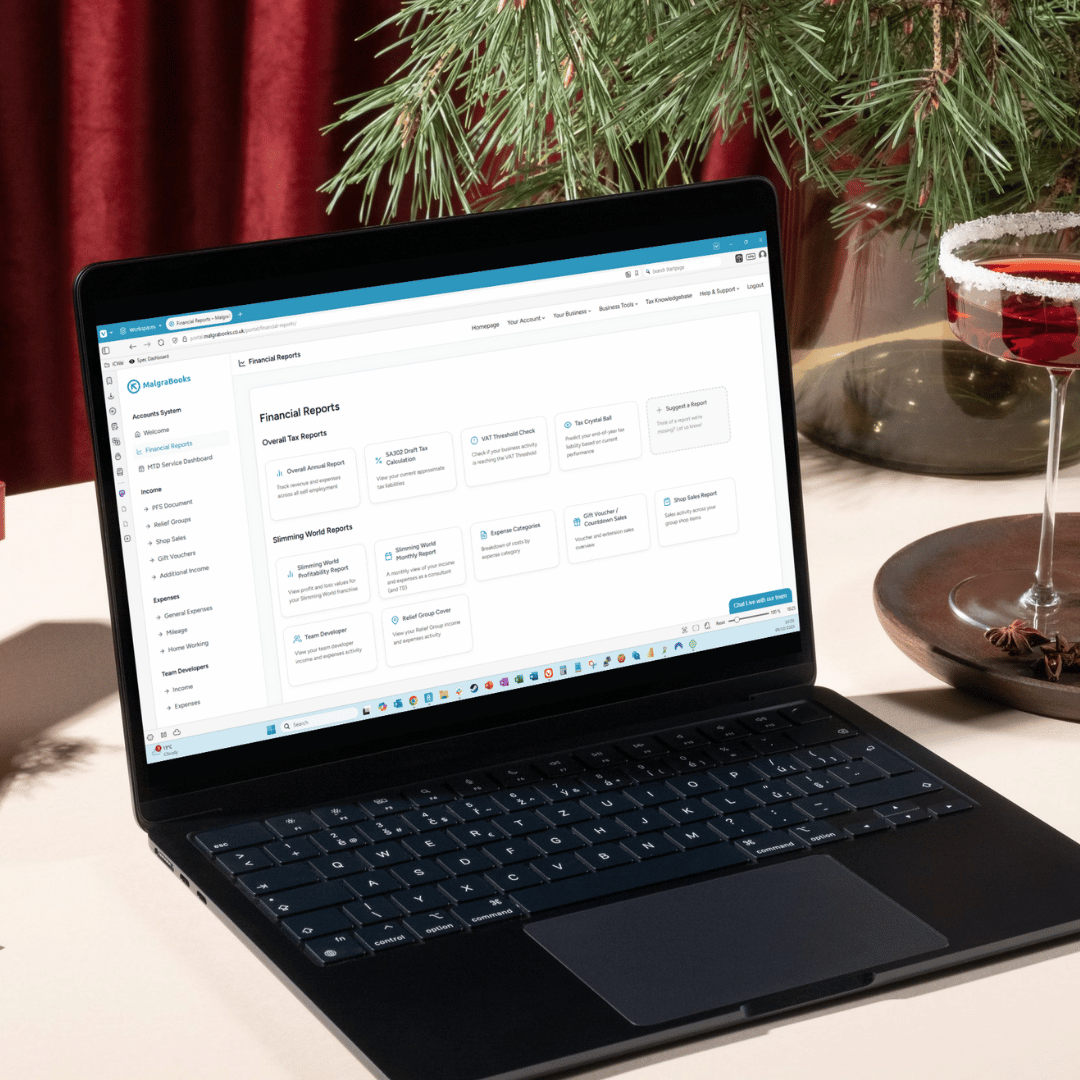

Our Business Portal, complete with comprehensive reporting tools, is perfect for you to keep track of your business.

Access key business information quickly and easily

Access your self employed accounts, add new figures, and view reports in real time

Our member dashboard provides access to our Pulse accounts software – access all features on the go, add new figures to your accounts and view reports in real time, showing exactly how much income/expenses you’ve incurred – as well as indicative tax and national insurance charges.

If you need help along the way, we’ve a range of videos, support guides and documentation available as well as regular webinars through the year.

Upload your business documents, view financial reports and HMRC documents

You’ll have access directly to your business information, including the ability to download tools and forms for helping our team complete your business accounts.

Each month, we’ll send a reminder to upload your business documents, and let you know once these have been processed, providing an overview of your business performance, as well as indicative and estimated tax and national insurance, so you can plan ahead for your tax return submission.

Check your quarterly reports and ensure compliance with MTD responsibilities

In addition to the features available on our Premium service, VAT packages come with quarterly compliance reporting to HMRC.

Your business cloud portal holds all information relating to your quarterly reports, VAT returns and MTD (Making Tax Digital) compliance requirements.