Perfect for busy consultants on the go

Our Premium Package reduces the administration involved with running your accounts. We’ll take care of most items, providing more time to concentrate on your business and members.

*All prices include VAT at the standard rate.

£285/per year

One-off payment by credit/debit card

£47.50/per month

Spread the cost over 6 monthly payments

Cloud Software

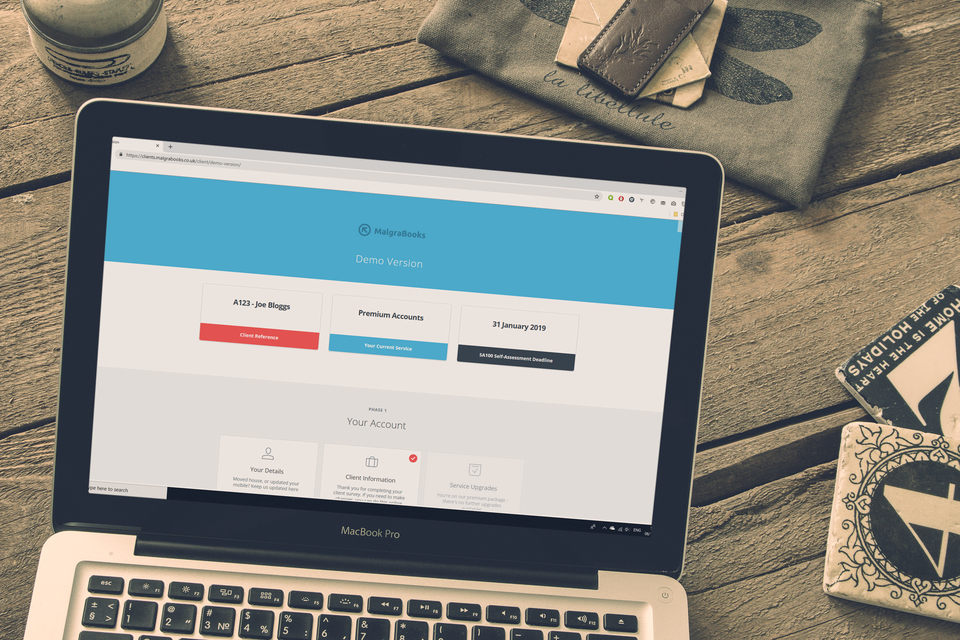

Secure portal

No software installation

Supports 5 groups

Well documented

Awesome support

MalgraBooks Premium

Our Premium Package is designed for busy consultants – you’ll find all features of our Advanced package included, but we’ll also help our with data entry of your group details, provide easy to use forms to collate additional information about your business, and provide ongoing monthly reports to help understand your business better.

Secure, Cloud Accounts

Access your cloud based accounts anywhere you are, just add your expenses and any shop income to our simple form – and upload your PFS Document for our team to process

Monthly Reports

Monitor the progress of your business each month – we’ll send you a report with full details of your account and check against HMRC Guidance along the way

Tax Return Submission

At the end of the financial year, we’ll prepare your SA302 Tax Summary and SA100 Tax Return ready to be sent to HMRC electronically

Supports other income

Have another job role (employment) or business (self employment)? No problem – we’ll include these figures on your calculations for you, ensuring the correct tax is calculated

Tax Knowledgebase Access

“Can I claim for..“ – search our tax knowledgebase for answers to common questions, with minimal accounting lingo, and examples tailored to consultant life

Awesome priority support

Keep in touch with our team directly by email, telephone, live chat and even video calls. You’ll also be invited to our regular webinars – and receive a priority response

£285/per year

One-off payment by credit/debit card

£47.50/per month

Spread the cost over 6 monthly payments

*Instalment pricing is available on current financial year services

Package Review

Sarah, Premium member since 2017