Perfect for Freelancers and Self Employed individuals

We know there’s enough complexities running your own business – your financial accounts shouldn’t be one of them. We’ll help sort out the finance administration so you have more time to build and develop your business.

*All prices include VAT at the standard rate.

From £225/per year

Includes Tax Return Submission

From £475/per year

Includes MTD VAT Quarterly submission

Our seamless service connects with a range of technology partners, actually making tax simple!

Cloud Software

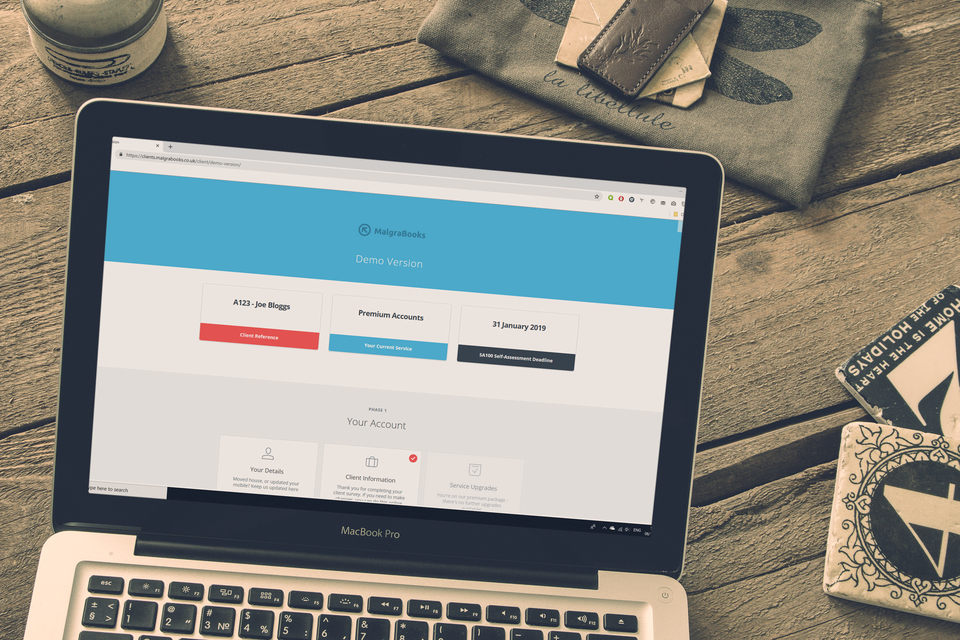

Secure portal

No software installation

Free Banking

Electronic submission

Awesome support

Small Business Solutions

Designed for busy self-employed individuals and freelancers, our simple and easy to use accounting process brings harmony to the requirements of the tax office. Upload receipts direct to FreeAgent* and the system will categorise these electronically for you. See profit and loss on the go, and when ready, our team will review everything and submit your return direct to HMRC. If you're on our VAT package, we'll also monitor and submit your quarterly returns. And if you need help, we're a message away.

FreeAgent for free!*

When you move your banking to Mettle (free of charges) or Natwest Business, you’ll receive FreeAgent for free – saving over £200 per year

Monthly Reports

Monitor the progress of your business each month – the system provides you with ongoing reports with full details of your business activity

Tax Return Submission

At the end of the financial year, we’ll prepare your SA302 Tax Summary and SA100 Tax Return ready to be sent to HMRC electronically

Supports other income

Have another job role (employment) or business (self employment)? No problem – we’ll include these figures on your calculations for you, ensuring the correct tax is calculated

Tax Knowledgebase Access

“Can I claim for..“ – search our tax knowledgebase for answers to common questions, with minimal accounting lingo, and examples tailored to freelancer life

Awesome priority support

Keep in touch with our team directly by email, telephone, live chat and even video calls. You’ll also be invited to our regular webinars – and receive a priority response

Totally free banking

We've partnered with Mettle (part of the Natwest Group) who provide free business banking for self employed individuals and sole traders. Protected by the FSCS and with totally free banking, you'll save over £200 with a complimentary FreeAgent licence to see your business activity - and to allow our team access to update and prepare your tax return for you.

From £210*/per year

Includes Tax Return Submission

From £475*/per year

Includes MTD VAT Quarterly submission

Service Review

Sarah, Premium member since 2017