Support for VAT Registered Consultants with HMRC regulations

Avoid the complex jargon. Our hassle-free Small Business service is designed for VAT registered Slimming World Consultants to meet quarterly HMRC requirements.

*All prices include VAT at the standard rate.

From £499*/per year

One-off payment by credit/debit card

From £49*/per month

Spread the cost and pay monthly

Cloud Software

Secure portal

No software installation

Supports 5 groups

Well documented

Awesome support

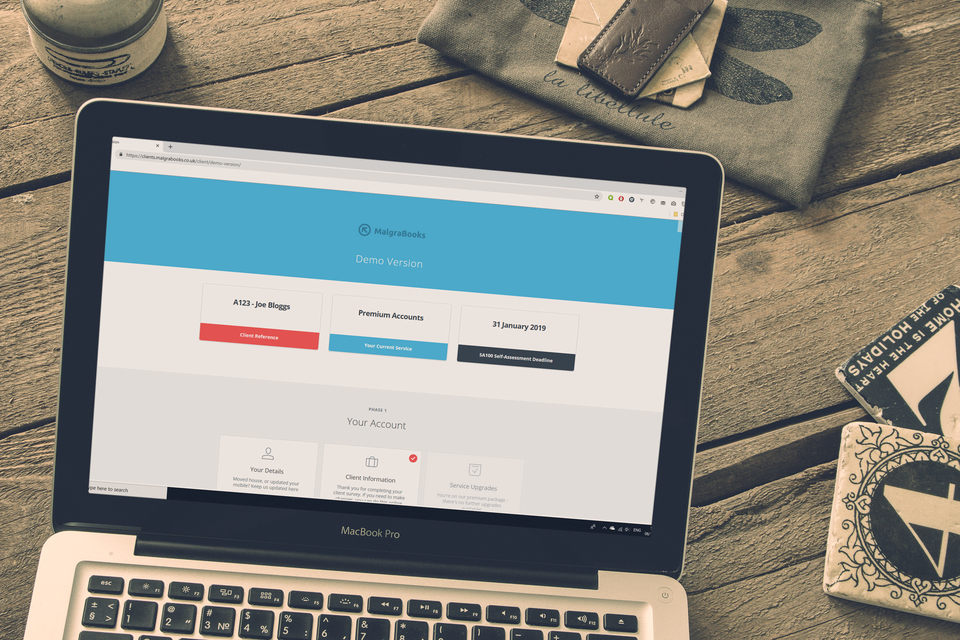

MalgraBooks VAT Service

Our VAT Service is exclusively tailored for busy Slimming World Consultants. Experience the comprehensive features of our Premium package while enjoying the convenience of our expert assistance in completing regulatory requirements for HMRC. Our team will provide user-friendly forms to effortlessly gather additional information about your business and deliver quarterly MTD for VAT reports to enhance your understanding of your business's performance.

Secure, Cloud Accounts

Access your cloud based accounts anywhere you are, just add your expenses and any shop income to our simple form – and upload your PFS Document for our team to process

Quarterly Making Tax Digital Reporting

Our team will prepare and submit your quarterly VAT return direct to HMRC – reducing errors and ensuring compliance with VAT regulations

Tax Return Submission

At the end of the financial year, we’ll prepare your SA302 Tax Summary and SA100 Tax Return ready to be sent to HMRC electronically

Supports other income

Have another job role (employment) or business (self employment)? No problem – we’ll include these figures on your calculations for you, ensuring the correct tax is calculated

Tax Knowledgebase Access

“Can I claim for..“ – search our tax knowledgebase for answers to common questions, with minimal accounting lingo, and examples tailored to consultant life

Awesome priority support

Keep in touch with our team directly by email, telephone, live chat and even video calls. You’ll also be invited to our regular webinars – and receive a priority response

The MalgraBooks VAT Service provides the below services:

- Registering you or your business for VAT

- Providing all necessary documentation, such as VAT certificate and VAT registration number

- Providing login details for an online VAT account with HMRC

- Monthly Bookkeeping or review of bookkeeping already done

- Preparing and filing VAT return

We will setup a business portal in a similar way to our existing MalgraBooks Premium service, however as VAT requires more enhanced record keeping and reporting, our team will be in contact more regularly to ensure we have all the relevant information we need from you.

The key items we’ll need will be:

- Various details about you and your business (to register for VAT)

- Regular communication to ensure we keep on track with HMRC reporting timeframes

- Monthly PFS Documents

- Details of remittance advices from Slimming World

- Information about your business (expenses, additional income)

- Any other income sources you have (such as employment or self employment)

You must register with HMRC for VAT when:

- Your total VAT taxable turnover (income) for the last 12 months was over £85,000

- if you expect your turnover to go over £85,000 in the next 30 days

VAT registration can take approximately 30 working days therefore it’s essential to complete as soon as possible

Our charges are as follows:

| Annual Charge | From £499 |

| Monthly Instalments | From £49 |

| Setup Fee* | £25 |

| VAT Registration* | £50 |

*These charges may be waived where we have an existing managed relationship with MalgraBooks (i.e. you have previously used our Advanced or Premium services)

From £499*/per year

One-off payment by credit/debit card

From £49*/per month

Spread the cost and pay monthly

Package Review

Sarah, Premium member since 2017