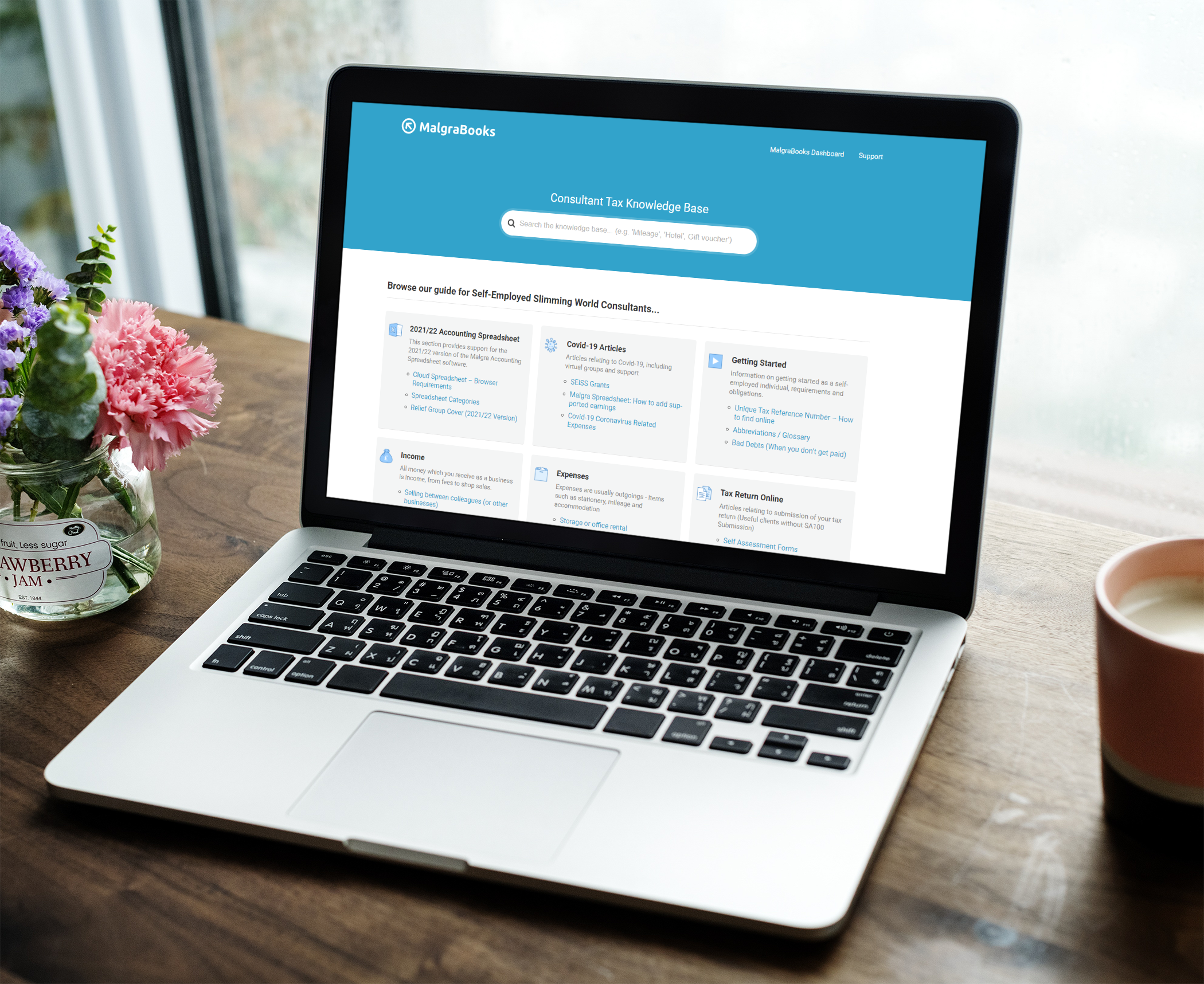

Access over 200 articles related to self employment

Launched in 2014, our Tax Knowledgebase has a wide range of articles all about self employment – but with a focus on how key items (income, expenses etc) relate to a consultant’s role.

We’ve cut out the jargon on complex tax matters and replaced with examples relating to consultant life, such as franchise accounts, eshop and more!

What type of content is in the knowledgebase?

There’s a wide variety of articles covering typical Consultant activity – from income and expenses, articles explaining how rent works as a consultant, and guidance on key times such as Gift Vouchers, Training expenses, taster evenings, and much more. We’re adding to the database all the time, and if there’s something missing you can contact our team who will be able to confirm and perhaps add a new article, helping more consultants too!

Is there any help to complete my tax return documents?

Yes. If you’re an Essentials member, we’ve articles explaining how to navigate HMRC’s system to complete and file your return, along with screenshots of how to use your personal tax account.

Note: If you’re on one of our managed services (such as Advanced or Premium), our team will handle this for you.

Do I need a MalgraBooks Account to access the knowledgebase?

Yes. From February 2022, you’ll need an active MalgraBooks account to access our Tax Knowledgebase.

We’re making this change following feedback from members that the guidance and support provided should relate to current MalgraBooks members who subscribe to one of our services.

What if I don’t have an account with MalgraBooks?

If you use different software or have a bookkeeper/accountant, you should contact them first to identify if a similar service offering is available.

Should your existing service not provide such an option of a tax knowledgebase designed for consultants, you can join MalgraBooks online.